Autonomous Vehicles: The Driving Force Transforming Mobility

Contents

Introduction

The long road ahead

Market forces

Regulations and other hurdles

Investment opportunities

Where can you still make money?

Market Segments

Where AV’s will be utilized

Impact

How this tech can change the industry

Market movers

Leaders & fast followers

Investors

VC / PE / Funds

Final Thoughts

One step at a time

The Long Road Ahead

Despite the speed bumps, AV's remain on the cutting edge of automotive innovation

The expectation for autonomous vehicles (AVs) over the past few years has been that they would change the nature of on-road driving, transforming the automotive and mobility industries. This market disruption would present a mix of both opportunities and challenges for automakers, suppliers, and mobility service providers. But after years of R&D and billions of dollars invested, many tech companies and automakers have had to postpone or scale back their original plans with regard to AVs due to the complexity of the technology, safety concerns, and the uncertainties of the regulatory environment.

However, the tremendous opportunity to transform mobility and offer solutions to such challenges as safety (by reducing the number of accidents), infrastructure (by allowing for fewer vehicles on the road) and climate change (AVs powered by green electricity or hydrogen helping to curb emissions) still exists. The unprecedented levels of technological advancement related to AVs in sectors such as artificial intelligence (AI) and robotics — from driverless taxis to automated cargo trucks and the convergence of the software, hardware, and data services industries — are in fact disrupting approaches to car building and operations.

To understand AV technology, the Society of Automotive Engineers (SAE) created the J3016 standard for Levels of Automated Driving, which divides AVs into levels based on their capabilities, categorizing them from 0 through 5, with 5 being considered fully autonomous.

As noted by Jack Pokrzywa, director of SAE’s Global Ground Vehicle Standards, the standard is a living document that will continue to evolve as the industry develops.

Photo courtesy of the Environmental Information Agency

Most AVs currently in production (e.g., Tesla Autopilot, GM Super Cruiser, Ford Blue Cruise) are Level 2. In February 2022, Mercedes-Benz became the world’s first automaker to obtain regulatory approval to produce vehicles capable of Level 3 autonomy. By May, its Level 3 system called Drive Pilot was made available in the European market — and it is expected to receive certification for California and Nevada by the end of 2022. In addition, Waymo, Google’s self-driving car project, has been operating a driverless taxi service at SAE Level 4 autonomy in Phoenix, Arizona; however, these vehicles are not yet commercially available.

Market Trends: Facts, Figures, Forces

Market FORCES

The introduction and adoption of AV in the market depends on a number of factors:

Regulations. Clear legislation for AVs needs to be developed more widely across countries.

Technology advances. AV technologies should be further developed in a collaborative way among such industry stakeholders as automakers, tech giants, suppliers, etc.

Business model. As AVs typically involve higher overall costs, especially when first introduced, business models need to be developed with this in mind in order to make AVs more accessible to consumers.

Consumer preferences. Comparisons between AV services and other mobility modes show that costs of AV services are much higher today, but could significantly decline as the technology advances.

New strategic partnerships. Emerging industry alliances could help create new market strategies that bring about positive changes regarding the direction of the industry.

Safety. According to the National Highway Traffic Safety Administration (NHTSA), the major factor in 94% of all fatal automobile crashes is human error. Higher levels of automation remove the human driver from the equation, thereby reducing the number of collisions.

Time to take the wheel?

The major factor in 94% of all fatal automobile crashes is human error.

market fACTS and figures

The car data industry is expected to be worth as much as $750 million by 2030.

In the United States, the AV industry could reach a value of up to $2 trillion by 2050, according to research from Intel and Strategy Analytics.

China’s market for AVs has the potential to become the world’s largest, generating market revenue of $1.1 trillion from mobility services and $900 billion from AV sales by the end of 2040.

Investment Opportunities

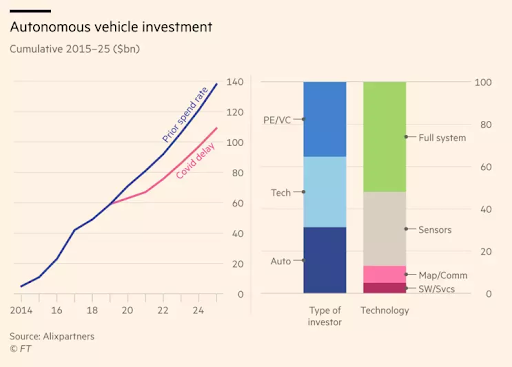

Over the last decade, investors have spent more than $200 billion in AV technologies and smart mobility — and that number is expected to increase as competition intensifies in the sector. Governments are also realizing the need to invest in infrastructure to facilitate AV production and adoption, as well as develop legislation to tackle the challenges that AV presents.

For investors, AVs present a number of opportunities and challenges, with the potential to impact several industries including healthcare, infrastructure, insurance, Internet of Things, etc.

Shared ownership of intellectual property between R&D partners can present a significant due-diligence hurdle for investors, while a lack of defined regulatory requirements create challenges to data collection, privacy protection principles, cybersecurity, etc.

Billions have already been poured into R&D for autonomous vehicles.

In recent years, automakers have strategically acquired complementary or competing startups to create joint ventures in order to speed up R&D and increase access to technology and data. For instance, Uber sold its self-driving unit to Aurora Innovation — which itself had already secured investments from Amazon, Sequoia Capital, and Graylock — and Motional was formed through a joint venture between Hyundai and Lyft in 2021.

Currently, in the United States, AV funding is dominated by Waymo, with $5.5 billion from its parent company Alphabet, and Cruise, backed by $10 billion from such automakers as GM and Honda along with other investors.

Market Segments

AVs encompass a variety of segments from components to vehicle types, to applications, to levels of autonomy, etc.

AVs components:

Camera Unit

Lidar

Radar Sensors

Ultrasonic Sensors

Infrared sensors

Applications:

Transportation

Defense

Vehicle types:

Passenger cars, e.g. ride-sharing vehicles

Commercial cars, e.g. trucks, buses

Levels of autonomy:

From 0-5

Impact

According to the US National Highway Traffic Safety Administration, a number of potential positive impacts may result from greater use of AVs:

Experts see fewer accidents if more vehicles are autonomous. A 2020 study from the Insurance Institute for Highway Safety predicts AVs may cut up to one third of crashes.

Increase in efficiency and convenience — in 2014, an estimated 6.9 billion hours were spent by people in traffic delays in the US.

Reducing pollution by improving efficiency and emitting less greenhouse gases into the atmosphere.

Increase in mobility for vulnerable groups, e.g. seniors and people with disabilities

The transition to AVs may, however, have a negative impact when it comes to job losses. More than 4 million jobs will likely be lost with a rapid transition to AVs, with driving occupations being the heaviest hit.

Market Movers: Current and Future Heavy Hitters

Market Leaders:

Microsoft Corp., which in February 2021 teamed with VW Group to develop an automated driving platform for self-driving cars and advanced driver assistance systems (ADAS) using Azure for computation, AI, and storage.

Cruise, a U.S. company owned by GM, in June 2022 was granted a permit to charge for self-driving car rides in San Francisco, having already run a live robotaxi service within a limited area in the city. It has also partnered with Walmart to deliver groceries in the Phoenix area, with plans to expand their services nationally. And in an alliance with GM and Honda, the company is set to mass produce its own electric AV called the Origin.

Waymo, a U.S. company owned by Alphabet, provides a commercial ride-hailing test service, Waymo One, in Phoenix, Arizona — in addition to Waymo Via, an expansion of its freight and cargo transportation service. Waymo’s self-driving cars use lidar sensors, which detect obstacles using 360-degree vision technology.

Nvidia, an autonomous driving partner of Jaguar and Mercedes-Benz, is the company behind the Drive Hyperion platform, an AI platform for self-driving cars.

Tesla Inc., the premiere U.S. company manufacturing electric vehicles, has developed a self-driving software platform that uses a deep-learning-driven improvement of its baseline advance driver assistant system (ADAS).

Baidu is a Chinese company that offers a self-driving taxi service in a number of cities in China through its ride-hailing platform. In addition, Baidu has teamed up with Geely (Chinese owner of Volvo) to fund Jidu, a mass-produced AV, for launch in 2023.

Zoox was acquired by Amazon in 2020, and is testing its fleet of Toyota Highlanders to offer on-demand autonomous transportation in urban settings.

Wayve is a U.K.-based driverless-car startup that uses AI with a focus on end-to-end learning. The company first demonstrated in 2021 that a car “trained” in the streets of London could self-drive to other cities in the United Kingdom without the need for additional inputs. In May 2022, Wayve announced it would be teaming up with Microsoft to train its neural network on Azure, their cloud-based supercomputer.

Waabi (United States), Ghost (United States), and Autobrains (Israel) are AV startups focusing on end-to-end learning using AI and super-realistic driving simulations.

Deep Route, Pony.ai, and Autox are Chinese startups with significant experience in the robotaxi ride services sphere that continue to advance the market (despite Pony.ai having lost its license to test its driverless technology in California after one of its AVs collided with a street sign in November 2021).

Argo -AI, a U.S. company backed by Ford and VW, is expanding its driverless operations to cities throughout the country.

Nuro AI is a U.S. company developing zero-emissions AVs for local deliveries. Its AVs are permitted to operate on public roads in California.

Venture Capital/PE and Other Fund Investors

Trucks Venture Capital focuses on investments in the future of transportation, and has acquired Cruise Automation.

New Enterprise Associates (NEA) invests in software, internet, energy, consumer, and enterprise technologies.

Toyota AI Ventures is an early stage VC arm of Toyota with investments in the AI, autonomy, mobility, and data spaces.

Sequoia Capital invests in startups in the energy, financial, enterprise, healthcare, internet, and mobile industries, typically partnering with early stage companies.

Silver Lake Capital is a VC firm that has invested $2.25 billion in Waymo.

Final Thoughts

The market for AV is still emerging, and although it has experienced some setbacks due to technical complexity, safety concerns, and the COVID-19 pandemic, there are still significant investments and large well-financed companies driving the industry forward.

AVs represent a tremendous opportunity for society, road safety, and a number of industries, investors, and startups alike. In addition, ever-expanding 5G technologies enabling AI and analytical capabilities in self-driving cars appears to be a key element in the future development and adoption of AVs.

There are, however, still many challenges — perhaps most notably, regulation — the AV industry needs to overcome before full Level 5 automation can be realized to truly transform the future of mobility.