Data Center Cooling: Heat Is On as Internet Use Surges

Contents

Introduction

Generating Heat… Lots of It

Market Trends

Hyperscale centers

Investment opportunities

Air and Liquid-based systems

Emerging and Promising Technologies

Market movers

Leaders & fast followers

Investors

VC / PE / Funds

Generating Heat… Lots of It

Gaming, streaming, shopping boost processing demand

As data centers around the world hum in their processing of nearly uncountable amounts of information, they are doing more than categorizing and storing. They are generating heat. Lots of it.

The number of data centers worldwide has soared to 8,300, as the planet’s output of information has skyrocketed to 64.2 zettabytes (that’s 64.2 followed by 20 zeros), thanks to the growth of video streaming, online gaming, cloud services, Internet of Things, artificial intelligence and more.

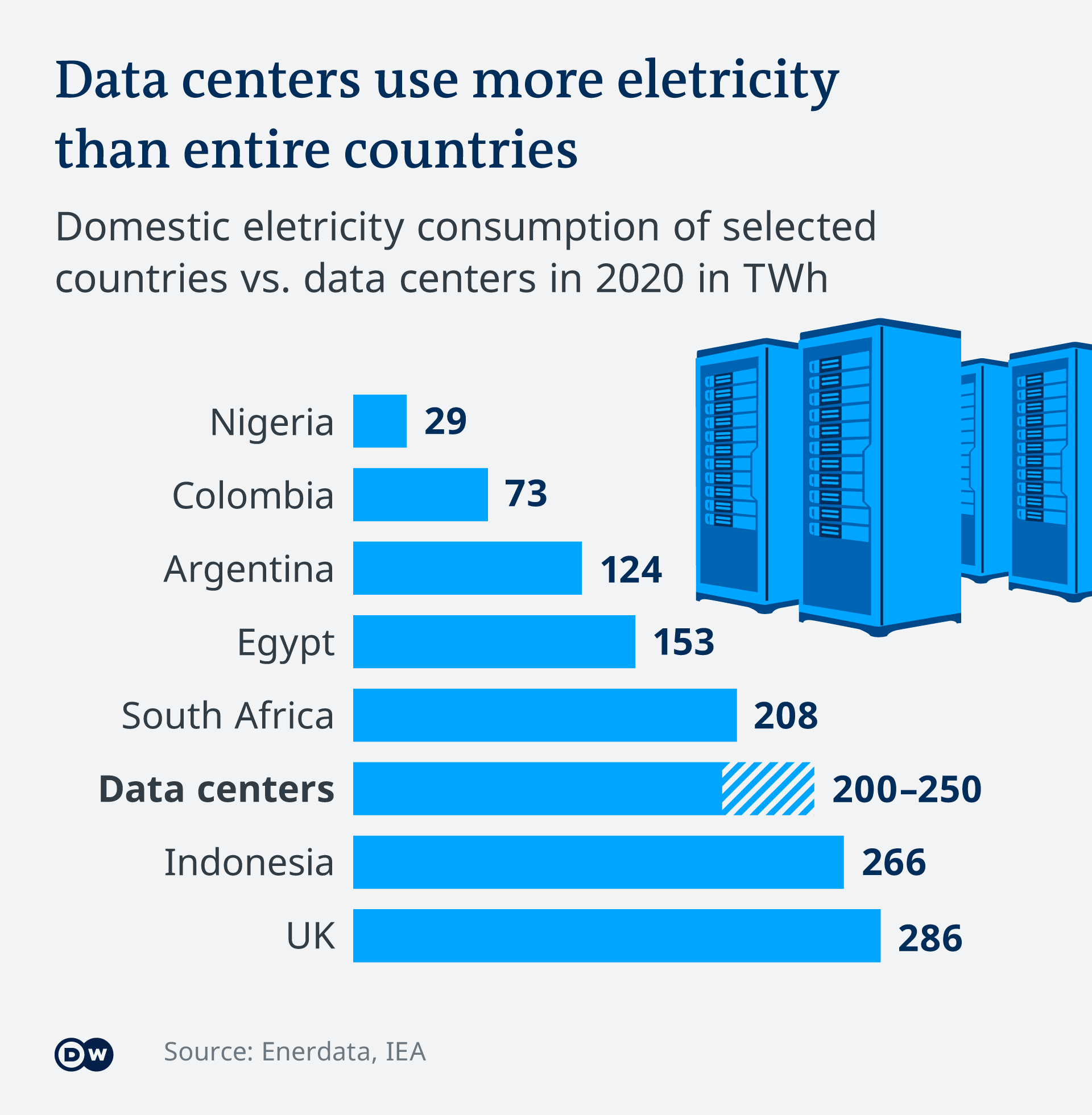

In 2020, global internet traffic increased by over 40%, with most of it going through data centers. These facilities used about 1% of the world’s electricity that year, not including energy use for cryptocurrency mining. Additionally, the power intensity of data centers continues to grow due to the increased computing power of servers and their smaller footprint.

That’s a lot of heat, and a big contribution to global warming. In response, an entire industry dedicated to cooling these operations has developed. Data centers are growing in size and number, with the world’s biggest a 10.8 million square foot China Telecom facility in naturally cool Inner Mongolia. Companies are racing to build cooling technology that can keep up with the expanding footprint of data centers — not to mention “hyperscale” facilities — the increased efficiency of servers while helping to keep the computing industry maintain its green and clean reputation.

“The amount of digital data created over the next five years will be greater than twice the amount of data created since the advent of digital storage. The question is: How much of it should be stored?”

Cooling technologies are a primary part of data centers, removing heat produced by computers and servers, and in some cases transferring it to another system or piece of equipment for cooling or dissipation. Without them, servers can’t achieve optimal performance and could become damaged, resulting in excessive heat and significant stress on servers, storage devices, and networking hardware.

Being able to sustainably cool data centers lowers their environmental footprint worldwide. According to the International Energy Agency (IEA) data centers contribute to 0.3% of all global carbon dioxide emissions. Innovative technologies are being created that may prepare us for the computing-intensive future with flexibility and energy efficiency.

Market Trends: Hyperscale Data Centers

Market Forces

Demand for cooling equipment is being driven in part by construction of hyperscale data centers — warehouse-sized facilities that provide computing services as their core business. The world’s biggest data creators — Google, Microsoft, Amazon, Apple, Facebook — are among those companies leading investment in the market, which is expected to rise in value to $4.3 billion by 2024, a 39% gain from 2020, according to Omdia.

The liquid cooling portion of the market, including technologies like immersion and direct-to-chip, is expected to grow about 16% a year and roughly double over the next five years, Omdia said.

Data center operators are introducing more cost-effective, energy efficient and environmentally friendly cooling technologies. This is in part due to the shift to hyperscale facilities, and also because of new rules, such as the EU Green Deal plans for data center and information and communication technology industry to be carbon neutral by 2030.

Within the cooling market, the main two technologies include liquid-based and air-based cooling. Currently liquid cooling technologies are at a growing stage as it has higher efficiency for high rack densities compared to air-based cooling systems.

Market Facts & Figures

The leading data center operators focus on adopting efficient and innovative cooling technologies that reduces the Power Usage Efficiency (PUE) from a typical 2.0 to about 1.1 (a PUE of 1.0 being a perfect score).

Building data centers in cool regions efficiently reduces electricity consumption and greenhouse gas (GHG) emissions. Google and Microsoft are among companies with data centers in Finland, where air and water from outside help keep the facilities at a proper temperature.

Around 40% of data center’s energy consumption comes from cooling. Innovators are rolling out a new generation of technologies that keep energy costs down while enhancing reliability. Newer equipment includes chilled water and evaporative cooling as well as forms of liquid technologies.

Investment Opportunities: Air-based, Liquid-based

The data center cooling industry encompasses several segments, each presenting investors with a range of opportunities and risks based on the technologies:

Air-Based Cooling

Traditional cooling technologies that constitute a large share of the market.

CRAC (computer room air conditioner) and CRAH (computer room air handler) units equipment are comparatively inexpensive.

Systems continue to evolve addressing higher densities with greater efficiency.

Efficiency is a risk: a point exists at which air doesn’t have thermal transfer properties required to provide sufficient cooling to high-density racks in an efficient manner. This might lead to reduced performance, reliability and sustainability

Liquid-Based Cooling

The liquid cooling systems segment estimates to have the highest growth in the global data center cooling market. Such growth is due to their advantage over air cooled systems. Benefits include:

Improved performance

Reduction in acoustical noise levels

Improved energy efficiency

Sustainability - reduces GHG emissions

Maximize space utilization limiting the need to expansion or new construction

Reduced cost and higher efficiency than air-based cooling

Risks include complicated processes and potential high water consumption rates

Emerging and Promising Technologies

Immersion Cooling

This technology involves submerging the hardware itself into a tub of non-conductive, non-flammable dielectric liquid. Both the fluid and the hardware are contained within a leak-proof case.It holds promise for high-end data centers. Since entire servers can be submerged into dielectric cooling substances, the fastest way to cool overheated systems, it optimizes cooling capacity, though with inconveniences in server maintenance.

Direct-to-Chip Cooling

This represents another component of the market where innovation is expected the most. With cold plates filled with coolants, it is more convenient to maintain than immersion cooled servers, while being able to optimize cooling capacity.

Apart from cryptocurrency and scientific research, even complex artificial intelligence and machine learning applications are increasingly requiring direct-to-chip and liquid immersion cooling techniques.

Data Cooling Centers' Impact

Using more sustainable data center cooling technologies can bring down the overall impact of data center cooling globally, enabling the continued growth of data centers on increasingly small footprints.

“We should have a much bigger purpose, and really think about what legacy we leave behind. Is it going to be just these massive data center, buildings? Or do we really rethink the future, and still meet all of the needs of our customers AND planet.”

Market Movers: Current and Future Heavy Hitters

Market Leaders

Vertiv: Based in Columbus, Ohio, Vertiv sales are estimated to make up 23.5% of the data center cooling market.

Schneider Electric: The French company in November 2021 announced a partnership with Chilldyne to sell direct-to-chip liquid cooling solutions in the market.

Black Box Corp. has 45 years of experience providing communications and IT infrastructure and networks.

Nortek Air Solutions is the top provider of data center cooling for Facebook parent Meta.

Airedale International: Based in U.K., Airedale has worked with companies such as IBM, HP, and Barclays.

Others include Hitachi, Rittal Gmbh & Co and Fujitsu.

Future Heavy Hitters

Cloud&Heat Technology: Based in Germany, the company offers customized designs for data center scaling, that rely mainly on water based cooling technology.

Iceotope makes a liquid cooled computer server platform for high performance computing, cloud and enterprise solutions. Based in U.K.

Asetek: Norwegian company develops and distributes advanced vapor phase and liquid-cooled thermal management solutions for the consumer electronics space.

Submer of Barcelona makes immersion cooling equipment.

Venture Capital/PE and Other Fund Investors

Planet First Partners Purpose-led growth investment platform investing in "Better for People & Better for the Planet" companies. In 2022, it became the lead investor in Submer

Aster Capital Invested in Iceotope’s liquid cooling technology.

The Internet reached 65% of the world’s population, or 5.17 billion people, as of July, 2021, according to Domo’s “Data Never Sleeps” infographic

Final Thoughts & Potential Risks

With the growing metaverse, online shopping, bitcoin mining and Internet of Things, the number of data centers will continue growing and each requires more efficient cooling technologies. New technologies will require time to penetrate the market that is familiar with existing cooling solutions, but investing early in such technology will see long term returns when the power intensity of data centers continues to grow and new technologies go from experimental to necessity.

The high cost of setting up and maintaining cooling solutions is one of the major restraints for the data center cooling market’s growth. Colocation will hopefully offer more flexible solutions and concentrate the capital costs.

Retrofitting of old data centers might not be able to host new cooling solutions, especially when it involves the construction of new cooling towers. Innovative solutions that offer the setting up of data center cooling systems with minor changes to the existing setups at a relatively low cost could help with this constraint.