Food Waste Management: Food For Humans, Not Landfills

Contents

Introduction

Highlighting a Polarized World

Market trends

Facts, figures, forces

Market movers

Leaders & fast followers

What is Food Waste Management’s impact?

Less Wasted Food

Investors

VC / PE / Funds

Final Thoughts & Investment Outlook

Cautions, downsides

Food For Humans

Waste and the highlighting of a polarized world

Perhaps nothing illustrates global polarization as starkly as food waste. Despite some 957 million people across 93 countries not having sufficient access to quality food, and another 135 million suffering from acute hunger, about 17% of food produced globally — and 40% of all food in the U.S. — is wasted.

Food waste also has a significant impact on our environment, responsible for 10% of global greenhouse gas emissions (GHG), according to data from WWF and Tesco. This is equivalent to twice the annual GHG emissions from all the cars in the U.S. United States and Europe combined.

“Food waste refers to food that completes the food supply chain up to a final product, of good quality and fit for consumption, but still doesn’t get consumed”

Food waste is also burdening our landfills. According to the U.S. Environmental Protection Agency (EPA), food is the largest category of waste in municipal landfills — and it emits methane, a greenhouse gas, as it decays.

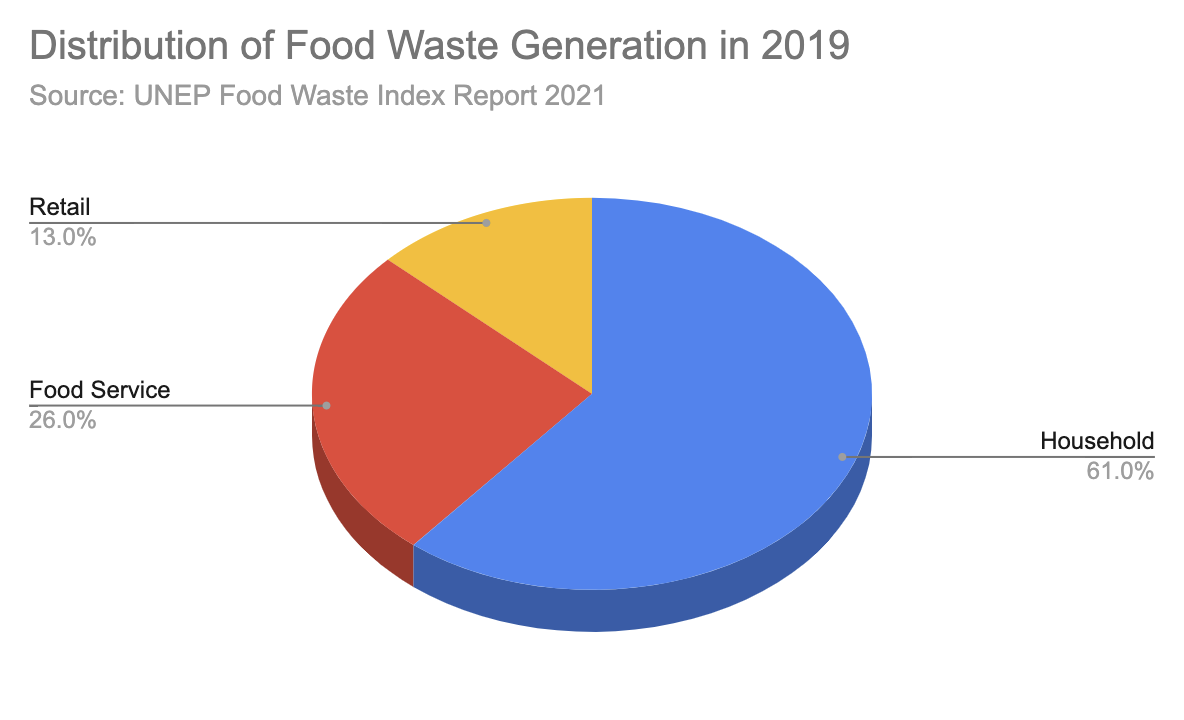

Consumers aren’t the only ones wasting food: overproduction by farms and food manufacturing are also major contributors. In 2019, 13.8 million tons of crops were left unharvested, and food service companies sent 9.6 million tons of food to landfills, according to ReFED. To be sure, homes and by consumer-facing businesses like restaurants and grocers are responsible for more than 80% of waste, says ReFED, a U.S. non-profit seeking to eliminate the problems.

Apart from enacting policies and raising awareness, opportunities to manage food waste using digital technologies and business-model innovations are growing, as evidenced by the increasing numbers of solutions to reduce food waste in the market.

Source: ReFED

Market Trends: Facts, Figures & Forces

Market Forces

To achieve the UN Sustainable Development Goal of Zero Hunger — and in an effort to commit to the Paris Agreement — global governments have begun setting goals and regulations to end food waste:

In the United States, USDA and EPA announced plans to cut food loss and waste in half by 2030.

The EU and its member countries are aiming to halve food waste per capita at both the retail and consumer levels by 2030, and have proposed a legally binding target to do so.

Just last year, China created a new law exclusively against food waste

California now requires businesses to recycle organic waste.

The highest inflation in 40 years is forcing businesses to find ways to reduce food waste and boost production efficiency.

The UN Food and Agriculture Organization (FAO) attributes reductions in harvest yields since 2000 mainly to unfavorable weather.

The group’s Food Price Index reached an all-time high in March 2022, jumping 34% over the course of a year.

Market Facts

According to ReFED, homes and consumer-facing businesses are responsible for the majority of food waste.

Fruits and vegetables are the highest category, contributing to over 40% of total food waste in the United States, while meat and seafood are the least-wasted foods.

Market Figures

U.S. private investments in food waste management rose 30% in 2021 to $4.8 billion.

The U.S. reaching its goal of cutting food waste in half by 2030 would require annual funding of $14 billion for R&D and implementing solutions — but would yield $73 billion in annual net financial benefits, ReFED says.

Market Movers: Heavy Hitters, Fast Followers

Heavy Hitters:

Too Good To Go is an app through which restaurants sell their leftovers at lower-than-usual prices. Founded in Copenhagen in 2016, it operates in 17 countries with more than 50 million users and claims to save 100,000 meals daily.

Goodr focuses on food waste solutions with services including surplus food recovery, organic recycling, and full-scale waste management. The Atlanta-based company boasts Capital One Ventures, the venture arm of Capital One Financial, as an investor.

Organix Recycling is a U.S. food waste recycler, based in Illinois. It claims to be the largest U.S. pre-consumer food waste collector and recycler, partnering with nearly 10,000 locations, such as stadiums and hospitals, across the nation.

Apeel uses patented materials to coat fruits and vegetables in order to extend their shelf life. The California company has raised $635 million from investors.

Misfits Market is an online seller of organic groceries, including produce that it says may be “too big, too small, or just sort of funny-looking.” The New Jersey company has raised $526.5 million.

Future Leaders:

OLIO is a U.K. startup that operates a food-sharing app through which consumers and businesses can share and sell surplus food. It claims around 5 million users and aims to expand outside the U.K.

ReGrained has developed technology to upcycle spent grain from beer brewing, and use it to make snacks, protein bars and more. The San Francisco company has raised about $3.2 million from two rounds of financing.

Copia, based in San Francisco, uses data analysis to match surplus food with those in need. The company, which has raised $4.9 million, says it has delivered more than 3.5 million meals to hungry communities.

TotalCtrl focuses on software solutions for food inventory management, helping businesses better manage both their inventory and the food supply chain to help reduce food waste. The company is based in Oslo.

Phood Solutions, based in New York City, sells a terminal equipped with a scale and camera. Combined with artificial intelligence, it helps businesses identify where food waste is occurring and how to prevent it.

What's the Impact of Food Waste Management?

Proper food waste management plays a significant role in reducing GHG emissions. In the U.S., for example, achieving its 2030 reduction goal would help eliminate some 75 million tons of GHG emissions annually.

Food waste management can also help the environment by reducing landfills and saving water.

Investing in food waste management helps address food insecurity. Technology being developed to match surplus food supplies with populations in need will go a long way toward achieving Zero Hunger, the No. 2 item on the U.N.’s list of Sustainable Development Goals.

The growing market for food waste management may also create more than 51,000 jobs in the U.S. by 2030 as the country seeks to reach its waste reduction goal, ReFED estimates.

The impact of reducing food waste:

The U.S. says cutting food its waste in half would help eliminate some 75 million tons of GHG emissions annually.

Venture Capital/Private Equity

Investing in soil health may require an unconventional approach and may be as much about passion as it is for portfolio. A search of the internet will turn up initiatives like the Soil Investment Hub, run by Geneva-based World Business Council for Sustainable Development. Impact investors including Europe’s Triodos Investment Management, with EUR6.4 billion under management, are investing in efforts to restore and prevent the degradation of soils.

Final Thoughts & Investment Outlook

A number of potential hindrances to food waste management need to be considered, including:

Consumer awareness of food waste has yet to reach saturation — and may take a long period of time to construct through education.

Funding for food waste management is far from sufficient, especially in developing countries where food is unevenly distributed.

Most food waste management technologies are currently not cost-efficient for many small and medium businesses.

Despite efforts to eliminate it, food waste is inevitable.