Plant-Based Protein: Grabbing a Share of the Dinner Plate

Contents

Introduction

Plants — the sustainable alternative?

Market forces

Changing diets and other facts

Investment opportunities

Meat, Seafood, Dairy Alternatives

Segments

Wheat, Soy, Pea

More Food, Less Carbon

Plant Protein's Impact

Market movers

Leaders & fast followers

Investors

VC / PE / Funds

Plant-Based Protein — the Sustainable Alternative?

From Legumes to 'Shrooms, consumers have more green protein options

Veganism, vegetarianism, flexitarianism — all are on the rise. If you’re like many consumers, you’ve eaten more peas and soy in the past few years than you ever would have imagined.

And yet, the world is eating more meat. Despite growing warnings of health and environmental consequences, the planet’s population set a new consumption record last year.

This is not just because more of us are walking the planet. Thanks to rising incomes, meat consumption has quadrupled since the early 1960s. And these days, the planet’s nearly 8 billion inhabitants consume around 350 million tons a year. This is good news for steak lovers and the meat industry, which is estimated to reach about $1 trillion a year in sales.

For people concerned that meat production is damaging the planet’s air, soil, and water, the statistics are another warning that the status quo isn’t sustainable. Perhaps you’re among those who feel that eating meat is unethical or worry that long-term beef and pork consumption poses health threats.

“Meat consumption has quadrupled since the early 1960s to around 350 million tons a year. For people concerned that meat production is damaging the planet, the stats warn that the status quo isn’t sustainable.”

These concerns are helping to boost the alternative protein market, encouraging consumers to eat food based on peas, soy, fungi, and beans (not to mention other sources such as bugs and lab-grown meat and fish) — diet options that are grabbing the attention of investors, marketers, and consumers looking for sustainable, healthy choices alike.

The growth of the alternative protein market largely depends on consumer tastes, although some countries including Israel and Canada have taken measures to boost the industry locally. Consumers around the world like meat, and the convenience of so much protein packed into each bite is a big part of its appeal (and seen by many as a “green” attribute of meat).

Still, more consumers are listening to scientists’ concerns about meat’s environmental impact: methane from cow burps, vast amounts of energy expended to feed animal herds, as well as carbon released in transportation and packaging. More and more people appear open to a good-tasting, reasonably priced alternative and consider themselves to be “flexitarian.”

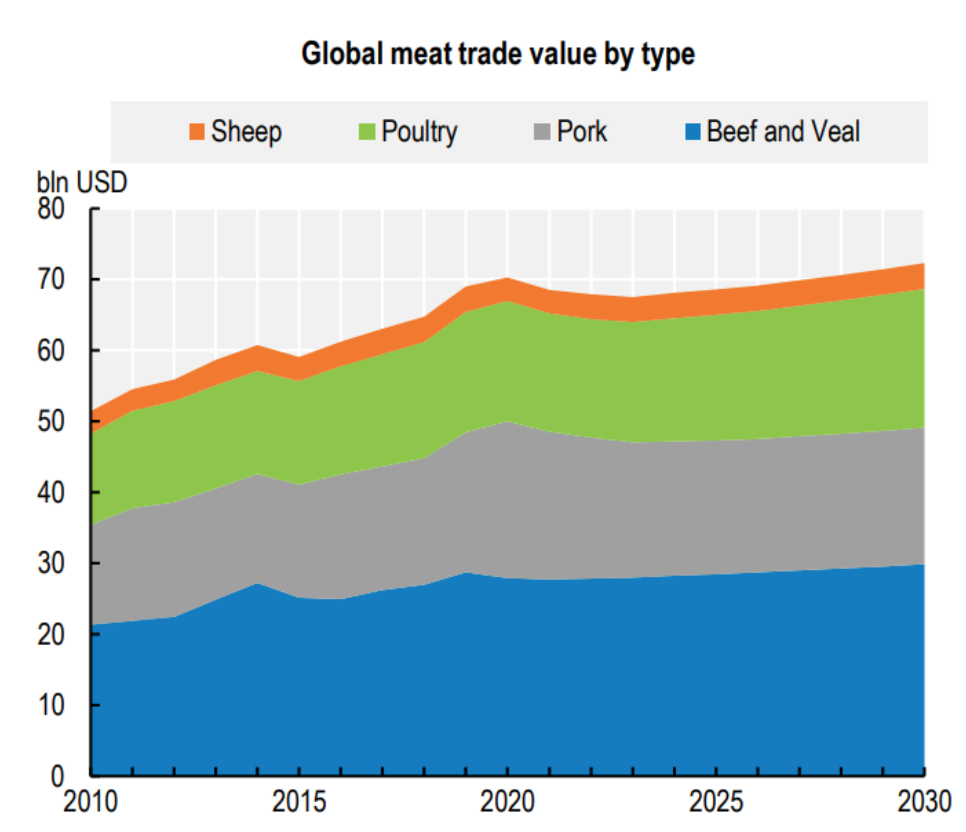

Source: Organisation for Economic Co-operation Development (OECD) and the Food and Agricultural Organization (FAO) of the United Nations

Our bodies require protein for muscles, bones, hair, and nails and for functions such as immune response, cellular processes and nutrient delivery. Some studies conclude that while protein is an essential molecule for life, most Americans eat too much of it, despite some older Americans not getting enough (meanwhile, the United States is the world’s “beef capital” in terms of consumption, while China produces the most meat overall.)

This means that alternative proteins, a market that barely existed a few years ago, is growing fast enough so that by 2035 they will replace 1 in every 10 servings of traditional protein such as eggs, meat, dairy, and seafood, according to a report last year from Boston Consulting Group. The report sees the market for such products reaching $290 billion in 2035. The need for sustainability consumption, the need to avoid allergens, and being compatible with vegetarian or vegan lifestyles are driving the growth of the global plant-based protein market.

Plant-based burgers from Beyond Meat, Impossible Burger, and others have triggered interest in alternative proteins in recent years. However, plant-based meat is just part of the story. Plant-based proteins are appearing more than ever in supermarket dairy cases and frozen dessert sections. Over $3 billion in revenue is generated annually by milk substitutes in the United States, with plant-based milk accounting for 15% of all retail sales of milk, growing 20% in the past year and 27% over the past two years, according to the Good Food Institute. This increase has also laid the groundwork for growth in other plant-based products by introducing consumers to the plant-based protein.

In general, these trends signal that plant-based protein foods are a potentially high-growth opportunity for retailers and brands.

Changing Diets & Other Market Forces

Market Forces

Shifting consumer behavior, growing innovation, continued declines in product price, and greater investor focus are all driving the growth of the plant-based protein market.

Twenty-nine percent of shoppers indicate that they are moderating their meat intake, compared with 9% of shoppers who indicate they consume no meat products.

Due to animal protein allergies, many meat consumers favor meat and dairy substitutes made of plant-based protein, which ultimately drives the plant-protein market.

Population growth is one of the main driving forces of plant-based food growth. The Asia-Pacific region is particularly vulnerable to limited food supply, and could dominate the plant-based protein market, which is expected to reach $64.8 billion by 2030, up from $13.5 billion in 2020, according to a report in New Food Magazine that cites Bloomberg Intelligence

Growing fast

Alternative proteins by 2035 will replace 1 in every 10 servings of traditional protein such as eggs, meat, dairy, and seafood, according to Boston Consulting Group. The market for such products will reach $290 billion in 2035, BCG says.

Market Facts

The United States represents the largest market share of plant protein, followed by Canada and Mexico.

According to Bloomberg Intelligence, the plant-based foods market could constitute up to 7.7% of the global protein market by 2030, with a value of more than $162 billion, up from $29.4 billion in 2020.

The alternative protein industry raised $3.1 billion in investments in 2020—three times more than in any single year in the industry’s history.

Market Figures

In 2020, global per capita consumption of milk substitutes reached about 800 grams.

Investment Opportunities: Meat, Seafood, Dairy Alternatives

Investments in plant-based protein companies soared 61% to $5 billion in 2021 from $3.1 billion the previous year, according to the Good Food Institute. Amid the social, environmental, and economic crises of 2020, these numbers signal a growing appetite for climate-friendly investments with returns beyond the bottom line.

The industry encompasses a variety of segments, including meat, poultry, and seafood alternatives, dairy alternatives, protein supplements, etc.

Meat, poultry, and seafood alternatives:

The plant-based meat market is estimated to reach $8.3 billion by 2025, recording a compound annual growth rate (CAGR)of 14.0%, in terms of value.

Price is one of the major restraining factors in the plant-based meat market, as it is relatively more expensive than animal-based meat, which is likely to impact its growth in price-sensitive markets such as Asia.

Dairy alternatives:

The dairy alternative market is expected to grow at a CAGR of 11.2% from 2020 to 2027 to reach $44.9 billion by 2027.

The global plant-based cheese market is anticipated to grow at a rate of more than 12.8% from 2020 to 2027.

Plant-based protein supplements:

The global plant-based protein supplements market size was valued at $5.35 billion in 2020 and is expected to expand at a CAGR of 8.6% through 2028.

Other segments include various products such as protein gels, capsules, cakes, cookies, and bites that are likely to grow at a slower rate in comparison with the other major protein supplements due to the strong competition from protein supplements including protein powders, bars, and RTDs.

Segments: Soy, Wheat, Peas

Plant-based proteins can come from multiple sources, the most common being soy, wheat, peas.

Soy protein is derived from soybean meal that has been dehulled and defatted. It is the largest segment in the plant-based proteins industry, accounting for nearly 60% of the global market. The global soy protein market reached nearly $8.9 billion in 2020.

More Food, Less Carbon: Plant Protein's Impact

The growing plant-based protein demand and availability are beneficial to both the environment and global food and nutrition supplies. Shifting away from animal-based foods can not only add up to 49% to the global food supply without expanding croplands but also significantly reduce carbon emissions, energy consumption, land use, and water consumption.

Based on life cycle assessment studies, 1 kg of protein from beef generates 45–640 kg of carbon dioxide equivalents (CO2e) compared with 10 kg CO2e per kg of protein from tofu. Research also shows that compared with soybean production, land requirements are significantly larger for meat protein production. All these potential impact reductions would reduce both direct and indirect threats to earth’s health and habitability for not only people but all wildlife, flora, and fauna.

However, the exact footprint of plant-based protein still depends on the types and sources of the feedstocks. For example, almonds and walnuts are some of the most water-intensive large-scale crops.

“The investor community is waking up to the massive social and economic potential of food technology to radically remake our food system.”

Market Movers: Current and Future Heavy Hitters

Market Movers:

Royal DSM: This Dutch multinational is active in health, nutrition, and associated materials. The company targets a 50% absolute reduction of its direct greenhouse gas (GHG) emissions (Scope 1) and emissions from purchased energy (Scope 2) by 2030.

ADM: Chicago-based ADM, is a food processing and commodities trading corporation that operates more than 270 plants and 420 crop procurement facilities worldwide.

Kerry Group plc. This publicly held Irish company is divided into several business areas: ingredients and flavors, consumer foods, and agribusiness. The Group aims to cut its emissions by 55% by 2030 and reach net zero emissions before 2050.

Cargill. Based in Minnesota, privately held Cargill sells a variety of plant-based proteins from soy, peas, corn and wheat.

Future Heavy Hitters:

Impossible Food is the creator of the Impossible Burger. The company has raised over $250 million in funding from investors including Google Ventures and Bill Gates.

Beyond Meat is a producer of plant-based meat substitutes that was founded in 2009 in Los Angeles, California, by Ethan Brown. The company’s backers include co-founders of Twitter as well as Bill Gates. Beyond Meat products are available in approximately 118,000 retail and food service outlets in more than 80 countries worldwide.

Eat Just, Inc. is a private company headquartered in San Francisco, California, that develops and markets plant-based alternatives to conventionally produced egg products. Having raised more than $220 million in funding, backers include the founder of Salesforce, Marc Benioff and Eduardo Saverin of Facebook fame, plus Temasek, Mitsui, Founders Fund, Li Ka-shing, the Heineken Family, and many more.

New Wave Foods is a developer of algae and plant-based seafood. The company aims to address the problem of overfishing in the oceans of the world with sustainable foods, such as plant-based shrimp alternatives made from sustainably sourced seaweed, soy protein, and natural flavors that contain the same amino acids found in meats.

Venture Capital/PE and Other Fund Investors

Lever VC, is a U.S.-Asian venture capital fund making early stage investments in the global alternative protein space, with a focus on plant-based and "clean" (cell-based) meat, egg, and dairy products and plant proteins, in addition to related companies, services, and technologies.

Big Idea Ventures focuses on plant-based, cell-based, and fermentation-enabled foods investment.

Blue Horizon is a VC firm that invests in companies and businesses in the agriculture and food processing sector, including THE EVERY COMPANY, Impossible Food, and Eat Just.

Final Thoughts

The plant-based movement signals a significant shift in both the way people eat and our understanding of the relationship between people’s food choices, human health, and the health of the planet. As people learn more about the impact of dietary choices on the resources that sustain the earth and human life — water, land, and climate — opportunities for companies that specialize in plant-based products and their investors are surging.