Textile Revolution: Raw Materials to Retail

Contents

Introduction

The problem we must address

Market forces

Are consumers ready and willing?

Investment opportunities

Growth on the horizon

Market segments

Natural vs. Innovative materials

Impact

Fashionable decisions

Market movers

Leaders & fast followers

Investors

VC / PE / Funds

Final Thoughts

Can innovation overcome costs?

A New Season for Fashion

Can sustainability stay in style?

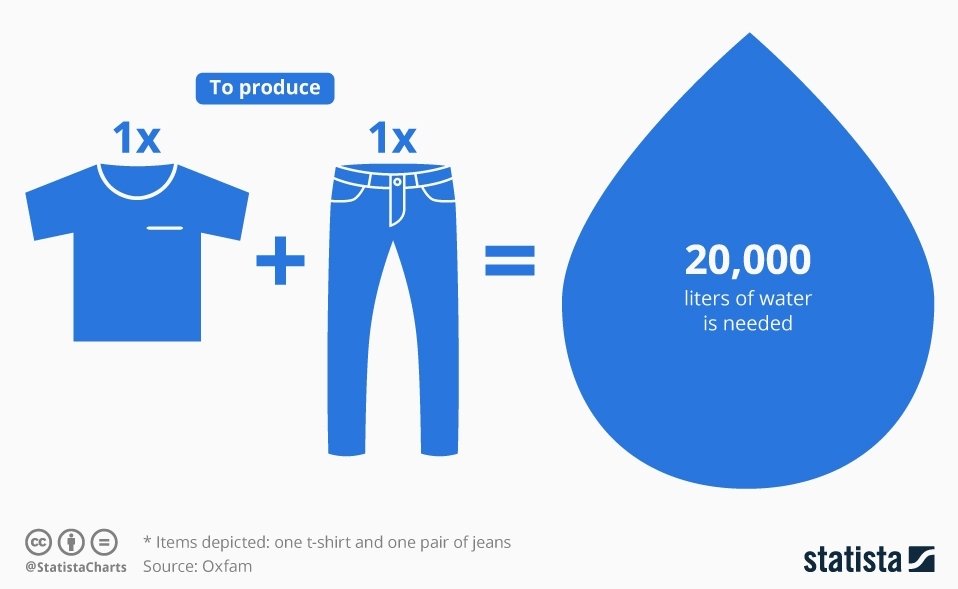

Seven hundred gallons is a lot of water, enough to keep the average person hydrated for more than three years.

Or to make a single cotton shirt.

As seasons change, stocks of pants, coats and shirts at malls turn over, fueling one of the world’s most over consuming industries: fashion. Fashion ranks as the second largest water consumer in the world, according to the World Economic Forum, responsible for around 20% of global water waste. Fashion also accounts for nearly 10% of all the world’s carbon emissions and 20% to 30% of microplastics found in the ocean.

That big environmental footprint can be blamed on the big amounts of energy and water required to make textiles, not to mention transportation and disposal of last season’s outfits, with one estimate saying 85% of the world’s textiles are incinerated or end up in landfills. Also, textile dying pollutes waterways, and the notoriously dirty chemical industry has a giant customer in fashion.

Currently, at least 60% of the global clothing exports are manufactured in developing countries. Asia is the leading world supplier producing 32% of the world’s clothing exports. Low-cost labor in Asia is an incentive for many companies to outsource manufacturing; while this boosts economic development it also raises concerns about working conditions and wages.

If left unregulated, by 2050, the fashion industry might account for 25% of the carbon budget – the amount of CO2 emissions permitted to keep the global temperature from rising too much. A push towards a sustainable industry, putting out durable, quality garments, has been underway for some time despite most of the world’s clothes being made from cheap, synthetic fabric.

The Insatiable Thirst For Fashion

Market Trends: Facts, Figures, Forces

Efforts towards having a more sustainable fashion industry include sourcing organically grown materials for textile production and the development of innovative technologies that produce environmentally friendly fabrics.

Facts and Figures

Eco-fibers, or textiles produced from organically sourced natural materials, aren’t considered goods produced at commercial scale yet. However, the U.S. eco-fibers market is expected to be worth $15 billion in 2025.

In 2020, 21 countries were producing organic cotton, India being the one with the largest market share (50%) of the global organic cotton production. Estimated by Textile Exchange, the global organic cotton production is expected to grow 48% in the next year.

The total hemp production for fiber-use was estimated to be 33.2 million pounds in 2021. At the moment, the hemp production for fiber was valued at $41.4 million according to the US Department of Agriculture.

Seventeen million tons of textile waste were generated in 2018, or 5.8% of all U.S. municipal solid waste, the Environmental Protection Agency says. More than half of that, or 11 million tons, went to landfills. Only 15% of textiles were recycled that year.

Forces

While efforts are being made to raise awareness of the environmental impact of so-called fast fashion, sustainable clothing brands that use environmentally friendly fabrics are still considered a luxury by 66% of consumers, a McKinsey survey shows. However, another McKinsey survey shows that young consumers are willing to pay more money for sustainable clothes.

Big companies are striving to reduce their environmental impacts, while improving the quality of their garments. In 2020, Zara, a giant in the fast fashion world, pledged to use 100% sustainable fabrics by 2025, following H&M which also pledged to use recycled or 100% sustainable materials by 2030.

In order to tackle greenwashing, governments are demanding transparency and accountability from fashion companies. For example, the UK’s Advertising Standards Authority (ASA) monitors for exaggeration of product sustainability through marketing strategies and the Norwegian Consumer Authority (CA) prompts better communication of company’s sustainable strategies.

Investment Opportunities

The transition to sustainable fashion may be very good for business. According to a 2020 report from Boston Consulting Group and Fashion For Good report called Financing the Transformation in Fashion, by 2030 “a financing opportunity of $20 billion to $30 billion per year” will exist for creating and developing technologies and businesses that will drive the change to sustainability.

The report communicates that most investing opportunities lay between the extraction of raw materials and end-of-use technologies. In order to commercialize sustainable solutions, investment should address the supply chain all the way towards the end of life cycle analysis.

It is also mentioned that the challenges of said transformation lay within misconception of prices. Fast fashion has programmed multiple generations to believe that garments can be inexplicably cheap at the cost of unfair wages and horrible working conditions. An understanding that sustainable fashion might be a little bit more expensive but of better quality and long durability, will be a cultural shift.

“The robust but still-emerging pipeline of innovations requires industry support and financing to advance from development to full commercial scale.”

Market Segments

The sustainable fibers market breaks down into natural and innovative materials. Natural materials are sustainable and renewable plant-based fibers. And innovative fibers are generally enhanced materials that address environmental issues or provide a better alternative.

Natural materials: used in textiles for clothing purposes include linen, jute, pineapple leaf, coconut fiber and organic bamboo, as well as the more widely used, organic cotton and hemp. Also, mushrooms seem to be making a breakthrough in developing plant-based leather products. The cultivation of these renewable materials should be monitored to avoid the over exploitation of said plants and the mismanagement of the soil they grow in.

Organic farming of cotton addresses loss of biodiversity in arable land, income inequality, and pollution of waterways. Currently, 82 companies have committed to the Textile Exchange’s 2025 Sustainable Cotton Challenge which says that by 2025, signatories will use nothing but so-called sustainable cotton.

Organic hemp grows fast and absorbs carbon quickly. It replenishes soil and naturally resists insects, eliminating the need for pesticides and herbicides. Companies continue to develop hemp clothing lines, as well as 70% cotton and 30% hemp garments.

Innovative fibers: are rising through technological development and provide sustainable alternatives to polyester and synthetic fibers, as well as plant-based fibers. Said innovations seek the enhancement of the material for it to be more durable, less harming to the environment and avoid the use of toxic chemicals. Some examples include Infinitied Fibers, Spinnova and more.

High Stakes Could Lead to Higher Profits

World economy will gain $175 billion annually if ESG concerns are addressed by 2030.

Impact

After the Covid 19 crisis, more and more consumers consider sustainability important when buying a product. Consciousness is growing and fashion companies are adjusting their strategies to more sustainable approaches.

In the The Pulse of the Fashion Industry, BCG estimates that by 2030, the world economy will gain $175 billion annually if the fashion industry successfully addresses major environmental and social concerns. The report also indicates that if the industry maintains its current trends, by 2030 fashion brands could see a decline in earnings before interest and tax (EBIT) margins of more than 3%; this would translate into a profit reduction of approximately $52 billion for the industry.

The use of renewable materials in plant-based fibers also provides the opportunity for crops to better the soil in which they grow. For example, cotton and hemp, if grown ethically and sustainably, can replenish soil and improve income inequality in developing countries that would benefit from farms and trade.

Market Movers: Current and Future Heavy Hitters

Leaders

Infinited Fiber makes Infinna, a completely natural, recycled and biodegradable fiber that serves as an alternative to virgin cotton. The company recently completed a funding round provided by H&M Group alongside Adidas and Zalando that raised $35 million to enhance their pilot manufacturing plant and new flagship factory.

Spinnova of Finland makes a fiber from the same pulp used to make paper. The company says it’s the first in the world to produce a cellulose derived fiber without the use of harmful chemicals, minimal water use and zero waste processes.

Bolt Threads makes Mylo, a leather substitute made from the mycelium in mushrooms. The product’s development has been by big companies like Adidas, Lululemon and Stella McCartney among others.

Piñatex is a non-biodegradable alternative to leather made from waste pineapple leaf fiber by Ananas Anam of the Philippines. The Certified B Corporation sources cruelty free and natural materials to produce leather that is now found in company lines like H&M and Hugo Boss.

Agraloop makes a plant-based fiber produced from crop waste and serves as an alternative to both cotton and hemp. The company says the product uses 99% less water than cotton and generates 42% less emissions than hemp.

Fast followers

Aalto University developed Ioncell, another cellulose based fiber. The fiber uses ionic liquid as solvent to process virgin wood pulp, recycled paper, cardboard, and other cellulose based fabric into high quality textiles. The project is currently seeking investment to reach commercialization.

Kuura is a paper-pulp based fiber, in which the raw material is strictly extracted from certified Finish forests and supports the local economy. The fiber was developed by Metsä Spring and they are currently testing out a pilot that, if successful, might be producing 50,000 tonnes of fiber per year.

Venture Capital/PE and Other Fund Investors

Kering’s Regenerative Fun for Nature provides grants to scale regenerative practices in cotton, cashmere wool and leather production. The fund has the objective of seeking betterment of life and climate while transforming agricultural practices.

The H&M group provides funding for innovative technologies to be included in their material sourcing. They recently invested in Infinited Fibre to increase production levels and further commercialize the textile of Infinna.

Fashion for Good invests in disruptive technology ventures. They have partnered with other groups that also seek out innovative startups and provide fundraising opportunities for upcoming technologies.

Final Thoughts

The fashion industry is quite known for its “dressing up” of what sustainability really is, explains Harvard Business Review. New business models like reusability and recyclability have failed to really positively impact the environment. Truly sustainable products struggle to make it to retail and harmful products are disguised as carbon friendly or “zero waste”.

The impact of the fashion industry is a sizable and big one that will need more than innovative materials to achieve carbon neutrality and sustainability. Stakeholders should also be focusing on consumerism and the disproportionate production and consumption of clothing.