Wind Energy: A Favorable Forecast

Contents

Introduction

Wind’s place in energy infrastructure secured

Market forces

Private, public support

Investment opportunities

Services, Supplies, Manufacturing

Segments

Onshore, Offshore, “Community”

Market movers

Leaders & fast followers

Investors

VC / PE / Funds

Wind Secures Place in Energy Infrastructure

At the same time, reliability, storage and other challenges remain

As the coronavirus pandemic raged, sickening millions and tossing the global economy into recession, wind turbines not only kept spinning—they multiplied. And they did so at a rate unseen in industry’s history.

Wind capacity expanded by a staggering 90% in 2020, or nearly 125 gigawatts, enough to power about 88 million homes. This was mostly due to policy deadlines in China, the U.S. and Vietnam, according to the International Energy Agency’s Renewable Energy Market Update published May 2021. China made up a big portion of the expansion as it rushed to connect projects to the grid by decade’s end, and U.S. developers pushed to finish installations before the expiration of a tax credit.

Still, the forces driving wind’s expanding share of the global energy market remain strong. Public sentiment and government incentives increasingly favor wind along with other renewable energy sources. The business thesis sees companies increasingly adopting ESG guidelines, often pushed into doing so by big banks, pension funds and mainstream institutional investors like BlackRock Inc. Energy companies are facing skepticism when seeking to finance big carbon-extraction projects, as lenders raise concerns about projects that may be rendered obsolete by new laws, in a world facing a raft of environmental disasters.

While wind’s footprint is small — about 6% of world output — its growth rate is accelerating, with 80 gigawatts expected to come online this year. That will top 2019’s total, even if it falls short of the . The report also said most new power sources coming online are wind-based.

“Wind capacity expanded 90% in 2020, or nearly 125 gigawatts, enough to power about 88 million homes, mostly due to policy deadlines in China, the U.S. and Vietnam.”

Market Trends: Private & Public Support

Facts, figures, forces

Market Forces

The Biden administration has ambitious plans for wind energy, planning to allocate $3 billion to federal loan guarantees for offshore wind projects and to invest in upgrading the nation’s ports to support wind construction. The administration’s plan to upgrade the U.S. electricity grid will further drive the cost of wind energy production down.

The administration has set a goal for a carbon pollution-free power sector by 2035.

Wind continues to gain a share of the broader energy mix, accounting for 7.2% of net U.S. electricity generation in 2019 and 42% of electricity generation from renewable energy.

Wind energy costs are expected to fall by as much as 49% by 2050.

Over that time, wind-powered electric generating capacity is expected to more than triple to 404.3 gigawatts.

Market Facts

The global wind turbine market was valued at $90.114 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 5.34% over the forecast period to reach a total market size of $123.154 billion in 2025.

In 2020, 42% of all new energy production in the U.S. came from wind energy, surpassing solar energy for the first time.

The top three countries in the world for wind energy production are China with 288.32 gigawatt (GW) capacity, the U.S. with 122.32 GW, and Germany with 62.85 GW.

The global offshore wind power market size is anticipated to reach a capacity of approximately 94 GW by 2026, exhibiting a CAGR of 19.2% during the forecast period.

Market Figures

The levelized cost of energy (LCOE) is used to compare wind to other energy sources. LCOE is the net present value of the unit cost of electricity over the generating asset’s useful life: Utility-scale onshore wind ranges from $28 to $54 per megawatt-hour (MWh), without subsidies.

Most wind farms still benefit from subsidies, reducing the LCOE to a low of $11 per MWh.

The marginal cost for coal energy is $36 to $41per MWh and for nuclear energy is $27 to $31per MWh.

Green economy

U.S. wind power installations in 2020 topped solar, representing $24.6 billion of investment, the Energy Department said. The U.S. wind industry supports 116,800 jobs.

Investment Opportunities: Supplies, Services, Manufacturing

The wind industry encompasses a variety segments, each offering opportunities to investors according to their risk profile: R&D, generation, turbine and parts manufacturing, electricity transmission, services. Storage, also known as batteries, is also ripe for investment.

Manufacturing & supplies

Investors can gain exposure to wind throughout the supply chain, depending on risk tolerance and portfolio strategy.

Generation & wind farms

Providing growth-stage capital for private companies is one method for supporting technological and operational innovations. Investors can also accelerate the deployment of wind turbines by financing projects and partnering with wind farm developers.

Venture-stage investments in energy storage technologies can offer ancillary exposure to wind. Storage capabilities can smooth intermittent generation patterns, reducing the need for peaking facilities. Innovators are developing turbines that can be deployed in deeper waters, where they can harness stronger and more consistent wind patterns.

Services

One method involves turbines fixed to floating platforms or buoys, which are anchored to the seabed by cables. Another concept uses an airborne “kite” that loosely resembles a drone. The development of novel technologies for wind facilities presents possible direct investment opportunities, as well as insight into how the industry is addressing current challenges.

Potential solutions revolve around these core themes:

Increasing access to consistent wind speeds, often at higher elevations that may require concrete towers, elevators, and other technologies to reach.

Avoiding the complicated gearbox that steps up the rotation speed 100-fold to generate electricity, including direct-drive technologies that use rare earth magnets or substitutes.

Making the generation process more efficient, through improved operational software, predictive maintenance, and artificial intelligence–enhanced siting decisions.

Storing wind energy for periods from milliseconds to hours to help smooth out grid fluctuations, and potentially delivering it when demand and prices are higher.

Improving transmission to customers through direct-current, high-voltage lines; grid modernization; and valuing the grid services that advanced wind farm electronics can provide.

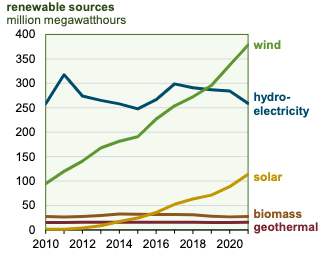

Wind Blowing by Other Renewable Energy Sources

The U.S. power sector produced more electricity from renewables than nuclear in 2021, the U.S. Energy Information Administration reported.

Segments: Onshore, Offshore, Small-Scale “Community”

Onshore, Utility Scale Generation

The largest onshore facilities generate electricity at a utility scale, comparable to power plants, providing emissions-free electricity. Massive wind farms are constructed in a few locations with the best access to consistently strong wind. Lower production cost is achieved through the increasing size of individual turbines and blades, as well as growing the number of units deployed on the farm.

Large utility companies are expanding wind’s share of their generation portfolios. Utilities that already have significant wind capabilities are receiving the greatest benefit from declining costs, leveraging their competitive advantage over smaller-scale rivals. This dynamic has evolved into an arms race of wind farm owners, turbine manufacturers, and utilities competing to develop and deploy larger, more efficient turbines.

Global investment in onshore wind reached $108.3 billion in 2019, a 7.4% increase from 2018.

The best locations for onshore wind energy production are typically in remote areas, making grid modernization critical for the continued increase of this energy source.

Wind turbines are primed to become more modernized and interconnected as other technologies such as 5G become introduced, leading to improved data collection and increased efficiency.

In 2020, wind turbines accounted for 8.4% of total U.S. utility scale electricity generation.

There are currently 57,000 wind turbines the U.S.

Small-Scale and Community Wind

Small-scale wind projects are typically under 20 MW in generation capacity and can serve 20 to 30 households. Rural and remote communities often lack the capacity to fund a project, so rights to electricity production can be used to entice the support of larger financial backers. Some communities may directly own a wind farm or purchase electricity at a fixed price from the operator.

Not all projects involve partnerships; individual households and organizations can deploy turbines on their property. This option is best suited for sites where grid access is difficult and electricity prices are high. These operations occur behind-the-meter, like residential solar, and use similar financing structures.

A small community wind project can cost anywhere from $10,000 to $100,000.

In 2016, the capacity-weighted average cost to install a new small wind turbine (domestic or imported) in the United States was $5,900 per kilowatt.

Small-scale wind systems are most practical in areas where existing energy costs are already high, between 10 and 15 cents per kilowatt hour.

Offshore Wind

Global offshore wind investment attracted $35 billion of investment in the first half of 2020, showing great resilience amid the COVID-19 pandemic. Many coastal states are pursuing offshore projects, though they must overcome a long history of roadblocks.

Vineyard Wind is one example. The project encountered a major setback in August 2019, when the U.S. Department of the Interior’s Bureau of Ocean Energy Management suspended the release of the project’s final environmental impact statement until December 2020. Issuance of the necessary permits rests on this statement, so construction is unlikely to begin before early 2021. Furthermore, the Biden administration has ambitious goals for offshore wind energy systems in the U.S., investing heavily to meet the goal of producing 30 GW by 2030.

In 2019, Europe recorded 3.6 GW of new offshore wind energy capacity, with Belgium, the UK, and Denmark all setting national installation records. Europe has a total of 22.1 GW of offshore wind capacity.

New Jersey has started work on the U.S.’s first wind port, a facility on the Delaware River strictly dedicated to turbine assembly and the marshalling of offshore wind construction.

The overall size of the U.S. offshore wind pipeline grew from 25,824 megawatts (MW) to 28,521 MW in 2019.

Wind's Impact

Wind energy doesn’t produce harmful emissions.

Wider wind energy use should cut into the amount of electricity produced by fossil fuels, reducing greenhouse gas emissions

Expanding the industry will create jobs, increase the use of sustainable energy sources and help boost energy independence.

Market Movers: Current and Future Heavy Hitters

Market Movers:

Vestas Wind Systems Vestas is a Danish manufacturer, seller, installer, and servicer of wind turbines. It has a capacity of 115 GW across 81 countries. In 2019, Vestas accounted for 16% of the world’s market share for wind turbines. Its market capital is $20.06 billion.

Siemens Gamesa Renewable Energy Siemens Gamesa has a total capacity base of over 99 GW across 90 countries. Its market capital is $11.61 billion. In 2019, Siemens Gamesa accounted for 14.5% of the world’s market share for wind turbines.

GE Renewable Energy is one of the world's leading wind turbine suppliers, with over 42,000 units installed across the globe. GE accounted for 12.1% of the world’s market share for wind turbines in 2019. GE Renewable Energy reported a $666 million loss for 2019 and a $498 million loss as of Q2 of 2020. In 2020, GE’s Haliade-X 12 MW offshore wind turbine prototype set a world record for generating the most electricity over the course of 24 hours.

Ørsted This multinational power company is the largest energy company in Denmark. Its market capital is $64.52 billion. Ørsted ranks number 1 in Corporate Knights' 2020 index of the Global 100 most sustainable corporations in the world. Ørsted is active in the bioenergy and solar and storage industries as well.

TPI Composites TPI Composites is the largest U.S.-based independent manufacturer of composite wind blades. For Q1 2020, it made $356.6 million in net sales and had a net loss of $0.5 million, or $0.01 per share. Its market capital is $1.48 billion.

Equinor is a Norwegian state-owned multinational energy company. Equinor’s flagship project is Hywind Scotland, a 30 MW deep-water wind farm with floating turbines. Equinor’s ambition is to be the “most carbon-efficient oil and gas producer, as well as driving innovation in offshore wind and renewables.” Its market capital is $49.285 billion.

Future Heavy Hitters

TPI Composites: Makes turbine blades, based in Arizona.

Boralex: Canadian developer of wind farms.

Aeolos Wind Energy: London-based maker of turbines for smaller generating applications.

Ripple Energy: UK-based company that permits individuals to own shares of wind farms that supply their power.

Venture Capital/PE and Other Fund Investors

Private equity is providing billions of dollars in capital to fund the expansion of renewable energy sources, including wind. U.S. private equity investments in renewables rose to almost $24 billion in 2020, a four-fold gain from the previous year, the American Investment Council said. That was about half of all private investments, which totaled $55 billion, according to the investment council.

Wind energy investments rose to $13.4 billion, which was more than the previous ten years combined, the council said.

Top investors include the world’s biggest private money managers, according to The Progress Pulse: Blackstone Group, Neuberger Berman, Apollo Management, Carlyle Group, KKR & Co., Bain Capital, CVC Capital Partners.

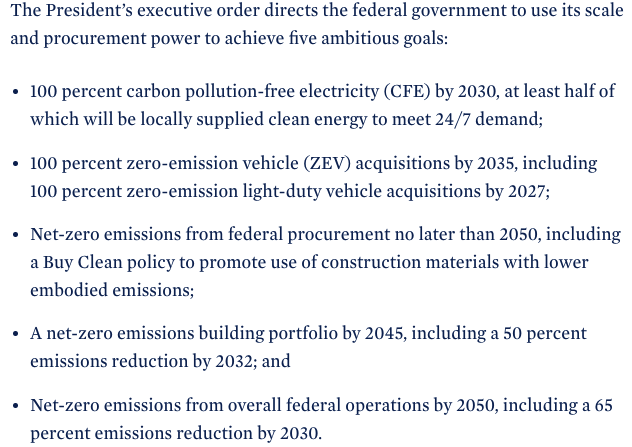

President Biden on Dec. 8, 2021 Signed an Executive Order calling for a “Clean Energy Economy Through Federal Sustainability”

Final Thoughts

For all of its benefits, wind has at least one major drawback: how do we make toast when the breezes stop? This is a problem that massive batteries are supposed to fix, but according to TK, a viable solution, which would permit wind to operate without the backup of coal-fired generators (which is the case in Texas), isn’t yet available. Lots of money is being poured into this, and the first to market with a cost-effective solution will pay investors back handsomely.

Recycling turbine blades

Location of turbines

Bird deaths: as many as 500,000 a year, among 200 species, are killed by spinning fan blades, according to the U.S. Fish & Wildlife Service. Still, the Audobon Society supports the spread of wind energy, as long as turbines are properly placed.