Crop Protection: Climate Change and the Demand For Better Pest Control

Contents

Introduction

A warmer planet requires more crop protection

Market forces

Biologics vs. synthetics

Investment opportunities

Fungicides

Segments

Different growth characteristics

Market movers

Leaders & fast followers

Investors

VC / PE / Funds

A Warmer Planet Requires More Crop Protection

Locusts, beetles among a host of pests blamed on climate change

When clouds of locusts stormed the Horn of Africa in 2018, threatening food supplies and livelihoods, warming of the Indian Ocean was blamed. The arrival of tropical fungal disease tar spot in the northern U.S. in 2015 and the northern migration of the destructive pine beetle are also blamed on a hotter planet.

To the list of threats to food production raised by climate change — including floods, drought and fire — add increasing populations of harmful insects, bacteria and fungi. Warmer weather means longer growing seasons for both crops and pests. And because every action has a reaction, this means more clouds of potentially hazardous pesticides being sprayed and applied in an effort to thwart the invading hordes.

Things created to protect us often have unintended consequences. Pesticides have boosted agricultural productivity and contributed to food security. At the same time, they’ve damaged beneficial microorganisms, interrupted natural processes, and may have caused cancer and other illnesses in humans.

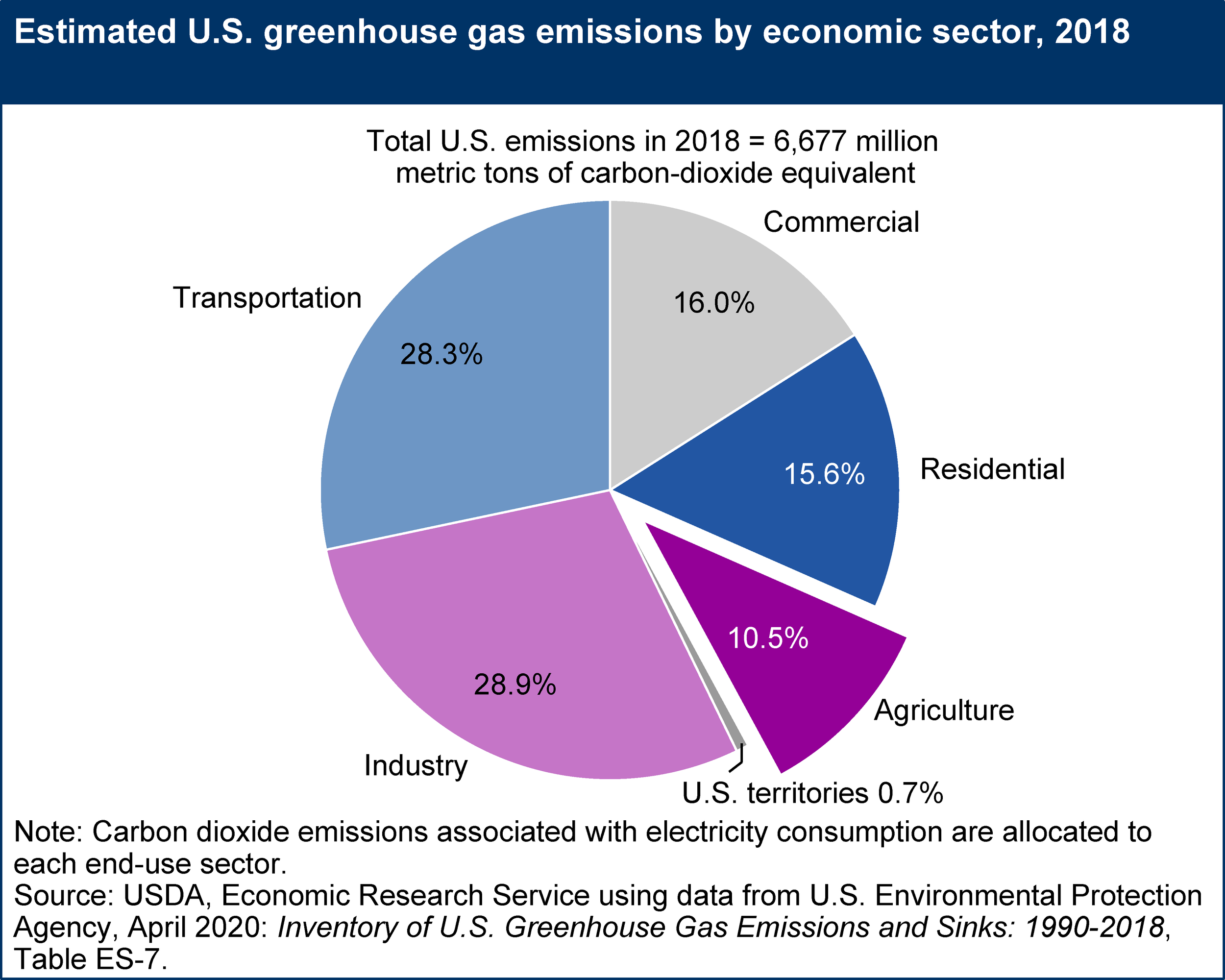

Their production is another problem, since the manufacturing of pesticides creates carbon dioxide, methane and nitrous oxide, which add to climate change. In the U.S., 11% of greenhouse gas (GHG) emissions leading to climate change are attributable to agricultural activities, according to the U.S. Department of Agriculture. In the U.S., agriculture is the No. 5 contributor to global greenhouse gas emissions, according to the USDA.

Natural fiber composites, for instance, possess mechanical properties, low density, and environmental benefits that industries may demand in the future. “The persistence in the environment of these biocomposites is significantly shorter compared to those that are entirely composed of oil-based materials,” authors of a 2021 study wrote.

Composites can solve many of manufacturing’s environmental concerns. Due to their lightweight nature, composites can reduce greenhouse gasses in transportation, making these materials a priority in helping companies and industry sectors seeking to reach net zero emissions.

The transition to sustainable composites, as promising as it sounds, faces challenges. Just because a composite contains a natural component, it doesn’t automatically qualify as green or eco-friendly, contend researchers from La Universidad de Las Palmas de Gran Canaria in Spain.

Some classes of composites require more energy during their production than traditional material like steel and aluminum, and recycling composites is far more complex than sorting into papers, plastics, and metals. Current recycling techniques often degrade the material’s performance, reducing value and future application.

As a result, only 15% of composites get reused or recycled, meaning investment in efficient, scalable recycling and circularity infrastructure are key to the industry’s future.

In addition, warming waters increases pesticide toxicity and as temperatures rise, the damage from even small amounts of pesticides in waterways worsens for fish and other aquatic life. Climate change may also reduce pesticide efficacy, and at the same time, longer growing seasons are probably leading to more insecticides and pesticides use.

Although agriculture contributes a significant part of global GHG emissions, it can also be part of the solution. By utilizing the soil as a carbon sink, by sequestering carbon in soil, farmers and investors can possibly stop the present increase in atmospheric CO2. Low carbon emissions and low toxicity crop protection products will play an important role in this mission.

Demand is growing for crop protection products, as the world economy and population expands and new pests and diseases spread around the planet. Companies and investors are increasingly investing in environmentally friendly solutions, aware that the cure must be less harmful than the problem.

“Evidence suggests that children are particularly susceptible to adverse effects from exposure to pesticides, including neurodevelopmental effects.”

Market Trends: Biologics vs. Synthetics

Facts, figures, forces

Market Forces

The earth’s population is expected to grow 25% to 9.7 billion by 2050, the United Nations estimates. Demand for food is rising even faster, as billions of people lifted out of poverty consume more calories. Clearly the need for crop protections will continue to grow for the foreseeable future.

Demand for crop protection is also supported by growing numbers of pests in crops, and the fact that more of them are becoming insecticide-resistant. Insecticides over time lose their effectiveness as pests develop resistance and companies are forced to invest more in R&D and create new products.

Market facts & Figures

The U.S. EPA’s last estimate for the worldwide pesticide market was $55.9 billion for 2012, a 14% increase over the previous five years.

The U.S. used 16% of the world’s pesticides, the report said.

Glyphosate was the most used active ingredient in all pesticides, the 2017 report said.

Investment Opportunities

The crop protection chemistry industry can be broken down into biological or bio-based crop protection and synthetic crop protection products.

Crop protection is one of the most highly invested segments in agtech. Together, two segments attract some $4.5 billion in disclosed venture capital funding between 2010 and 2020.

The fungicides market for biologicals is projected to grow at a higher CAGR.

Drone sprays pesticide on wheat field.

Market Segments

Biological crop protection products

The global organic food industry has recorded exponential double-digit growth rates. The increased organic farming across the globe is driving the market for bio-based crop protection solutions. Bio-based crop protection products are viewed as an attractive alternative for synthetic crop protection chemicals in many regions due to the increased stringent regulations on chemical use and chemical residue limit. Several European countries have initiated programs for promoting the use of biopesticides. While bio-based crop protection solutions represented only 6% of the global crop protection market, due to the driven forces mentioned above, investors focused 99% of all venture capital to the crop protection on biological startups.

Synthetic crop protection products

Synthetic crop protection solutions still dominate the global market of crop protection products due to the cost advantages and in-field performance, taking over 94% of all sales by value. In Asia-pacific areas such as India, synthetic pesticides have been extensively used for alleviating the loss of crops, due to the high incidence of pests and diseases. However, only 1% of capital is deployed in the synthetic crop protection segment between 2010 and 2020.

Among all the crop protection products, herbicides is the largest product sector, comprising 43.8% of the global crop protection market. The leading product by a large margin is glyphosate but this is now under increased regulatory pressure.

The insecticides markets comprise 25.3% of the global crop protection market. Among different types of insecticides, the global organophosphate market leads in terms of consumption followed by the pyrethroid.

The fungicides market comprise 27.3% of the global crop protection market. Triazole fungicides, also known as sterol inhibitors (SIs), are a large class of fungicides used globally on a wide variety of crops. The fungicides market for biologicals is projected to grow at a higher CAGR

Non-Green Crop Protections' Impact

Surface and ground water contamination: Pesticides can reach surface and groundwater through leakage and runoff from treated plants and soil. According to U.S. Geological Survey (USGS), more than 90 percent of water and fish samples from all US sample streams contained one, or more often, several pesticides.

Non-target target creature contamination: Pesticides are found as common contaminants in soil, air, water and on non-target organisms in our urban landscapes.They can harm plants and animals ranging from beneficial soil microorganisms and insects, non-target plants, pollinator, fish, birds, and other wildlife.

Pesticide residues in food commodities can potentially hurt people’s healthy

Market Movers: Current and Future Heavy Hitters

Market Movers:

Syngenta AG: Owned by ChemChina, Syngenta is among the world’s largest agricultural companies, with a focus on seeds and crop protection products.

Bayer Crop Science: This division of Bayer AG makes a range of crop protection, biotech and seed products.

Corteva: Spun out of DowDuPont in 2019, Corteva’s main product lines are Pioneer and Brevant.

BASF: BASF’s Agriculture unit sells a variety of seeds and crop protection products around the world.

Sumitomo Chemical: Sumitomo Chemical’s Agricultural unit sells agricultural chemicals (insecticides, herbicides, and fertilizers).

Future Heavy Hitters

GreenLight Bioscience: This plant and life sciences company develops RNA-based products, offering targeted biocontrols through their proprietary “GreenWorX” platform, aimed at protecting crops from pests.

Enko Chem: Based in Connecticut, Enko develops agricultural chemicals intended to revolutionize crop protection discovery. The company specializes in discovering small molecules for the control of agriculturally important pests, herbs, and fungus that damage the crop by producing toxic compounds and decrease the quality of the crop.

Vive Crop: Based in Toronto, Vive develops new products based on existing active ingredients for pesticides using its patented Allosperse technology.

BioPhero develops pheromone-based products for pest control.

Venture Capital/PE and Other Fund Investors

S2G Ventures has been investing in green agriculture companies since 2014.

Renewal Funds has $240 million in assets under management, including investments in crop protection.

DCVC Bio invests in so-called “Smart Agriculture.”

Final Thoughts

Human welfare and environmental protection are connected through the food supply chain, motivating manufacturers and consumers to consider the implications of using different crop protection products. At the same time, investors are taking their stand on crop protection products with efforts to boost environmental management and advocate for a more sustainable supply chain. Investing in crop protection products is a challenge but also an opportunity considering the growing market for crop production products, the growing demand of bio-based pesticides, and the potential of reducing greenhouse gases.